Sony Group Corporation ADR (NYSE:SONY) currently has a daily average trading volume of 3.38M but it saw 2842236 shares traded in last market. The company’s current market price of $17.53 came falling about -2.01 while comparing to the previous closing price of $17.89. In past 52 weeks, the stock remained buoying in the range of price level as high as $20.18 and as low as $15.02. In the recent trading on the day, stock has struck highest price mark of $17.4201 while lowest mark touched by it was $17.64.

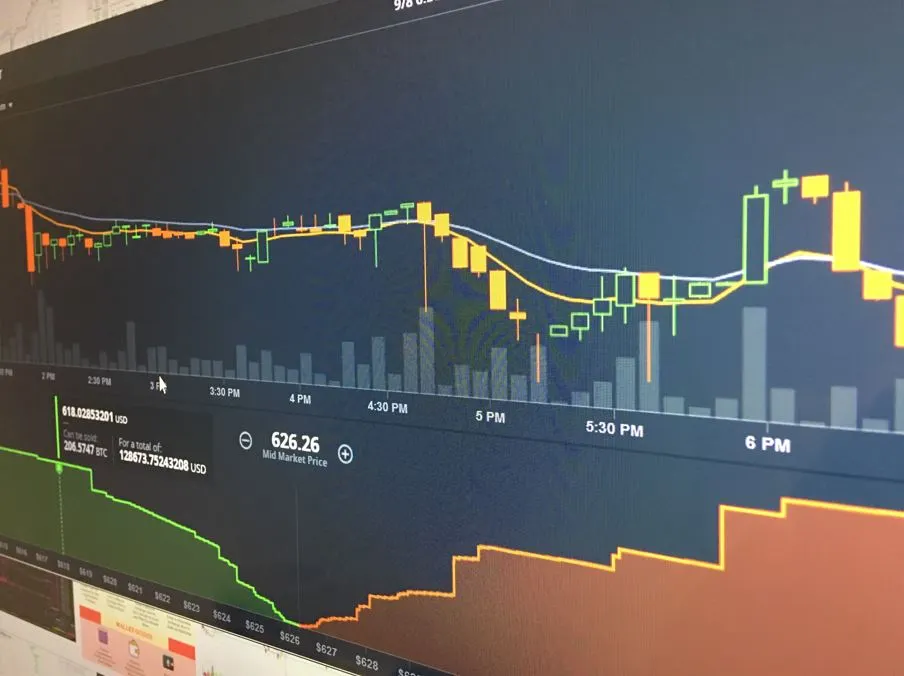

Taking a look at 20-day trading activity of Sony Group Corporation ADR (SONY) gives us an average price of $18.81, while its current price level is -13.11% below from 52-week high level whereas it is 16.70% above from lowest level seen by the stock during that period. Simple moving average of 50 days or SMA-50 of the stock’s closing price is $18.69 while that of 200 days or SMA-200 reads an average of $17.78. A closer look into the stock’s movement over the week reveals that its volatility is standing at 0.93% during that period while stretching the period over a month that increases to 1.19%. It is also necessary to take a look into other indicators of a stock too, to get a better idea about its price movement. And in doing so, we find stock’s 14-day relative strength index (RSI) standing at 30.56 which implies that the stock is in neutral territory.

Over the week, SONY’s stock price is moving -6.16% down while it is -8.28% when we observe its performance for the past one month. Year-to-date it is -7.43% down and over the past year, the stock is showing an upside performance of 5.46%.

The latest quarterly earnings report issued by the company reported quarterly earnings per share (EPS) of 0.22 beaten by the consensus estimate of 0.23 for the same. The company is expected to be releasing its next quarterly report on 2024-Nov-08, for which analysts forecasted an EPS of 0.27 while estimate for next year EPS is 1.15. In next quarter, company is expected to be making quarterly sales of $24.74B as analysts are expecting the sales for current fiscal year at $87B and seeing the company making $88.68B in sales next year. Moreover, analysts are in estimates of $20.14B for current-quarter revenue.

Company’s return on investment (ROI) stands at 10.63% and return on equity (ROE) at 13.58%. It has a price to earnings ratio (P/E ratio) of 81.72 while having a 14.17 of forward P/E ratio. Stock’s beta reads 0.95. Stock has a price to book (P/B) ratio of 10.93. Its return on asset (ROA) is 2.98% on average.