Companhia de Saneamento Basico do Estado de Sao Paulo. ADR (NYSE:SBS) does about 1.33M shares in volume on a normal day but saw 1324797 shares change hands in the recent trading day. The company now has a market cap of 12.37B USD. Its current market price is $18.10, marking an increase of 0.39% compared to the previous close of $18.03. The 52 week high reached by this stock is $18.36 whilst the lowest price level in 52 weeks is $11.10.

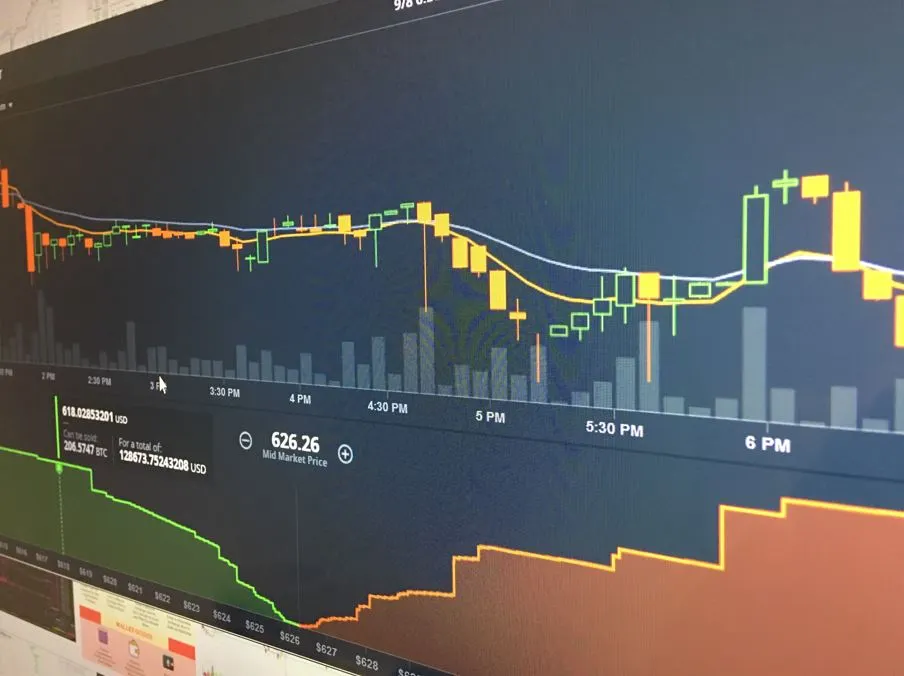

Companhia de Saneamento Basico do Estado de Sao Paulo. ADR (SBS) has a 20-day trading average at $16.40 and the current price is -1.42% off the 52-week high compared with 63.04% distance from its 52-week low. The 50-day simple moving average of the closing price is $15.17 and its 200-day simple moving average is $15.11. If we look at the stock’s price movements over the week, volatility stands at 1.68%, which increases to 2.12% over 1 month. It is also key to look at other market indicators of price movement for the stock, where we see that the relative strength index (RSI) is at 76.76 to suggest the stock is overbought.

The consensus objective for the share price is $21.96, suggesting that the stock has a potential upside of 17.58% over the period.

Companhia de Saneamento Basico do Estado de Sao Paulo. ADR (SBS) stock is up 2.32% over the week and 22.80% over the past month. Its price is 20.87% year-to-date and 58.55% over the past year.

The company’s next earnings report forecasts estimating quarterly EPS at 0.27 and 1.07 for whole year. Expected sales for next quarter are $995.1M, which analysts say will come at $3.88B for the current fiscal year and next year at $4.09B. In addition, estimates put the company’s current quarterly revenue at an average of $967.01M.

To reach the target analysts have set, the stock logically needs to grow 17.58 percent from here.

Outstanding shares total 683.51M with insiders holding 15.00% of the shares and institutional holders owning 10.14% of the company’s common stock. The company has a return on investment of 8.81% and return on equity of 13.88%. The price to earnings ratio (P/E ratio) amounts to 15.25 while the forward price to earnings ratio is 15.44. The beta has a value of 1.15. Price to book ratio is 2.16 and price to sales ratio is 2.29.